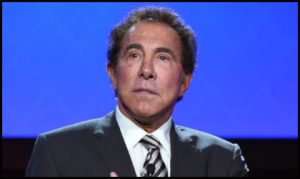

American casino operator, Wynn Resorts Limited, is reportedly set to ban 7BALL k a settlement worth $41 million following the resolution of a pair of lawsuits relating to the alleged discretions of the company’s former Chairman and Chief Executive Officer, Steve Wynn (pictured).

According to a Wednesday report from the Las Vegas Review-Journal newspaper, the legal actions were filed by investors in February and November of 2018 amid claims that the company’s stock valuation had been harmed following the emergence of sexual assault allegations against 77-year-old Wynn.

Severe accusations:

Connecticut-born Wynn helped to establish the casino firm that still bears his name in 2002 but resigned his executive roles in February of last year following the publication of claims that he had compelled some female workers into performing sexual acts and used private settlements to hush up any allegations of impropriety. The former casino magnate, who has continually maintained his innocence, subsequently sold all of his 11.8% shareholding in Wynn Resorts Limited to pocket approximately $2.14 billion and is now believed to have retired to Florida.

Company windfall:

The Las Vegas Review-Journal reported that derivative

Supplementary shifts:

Alongside the cash payments, the settlements are moreover reportedly set to compel Wynn Resorts Limited to make a series of changes to its bylaws including one that will separate its Chairman and Chief Executive Officer roles. The Nevada casino firm has additionally purportedly agreed to strengthen its board diversity and implement enhanced succession planning procedures when replacing senior executives.

Finally, the Las Vegas Review-Journal reported that the settlements are to furthermore involve Wynn Resorts Limited adopting 10b5-1 trading plans for executives and directors holding company stock worth over $15 million. It purportedly detailed that such a move will allow these investors to better avoid accusations of insider trading by establishing a predetermined time to offload their shares.

Definitive declaration:

In related news and the Las Vegas Review-Journal reported yesterday that the Nevada Gaming Control Board could now be set to hold an official hearing into the five-count complaint it filed last month against Wynn as soon as December 19. This purportedly comes as a result of the regulator’s dismissal of an objection that had been lodged by the septuagenarian in relation to the action that is seeking to have his earlier license suitability finding revoked and a fine imposed.

Arguable attitude:

The newspaper reported that Wynn had responded to the October 14 complaint by claiming that the regulator no longer held any jurisdiction over him because he had exited the casino business and no longer held any stake in Wynn Resorts Limited, which operates southern Nevada’s 2,716-room Wynn Las Vegas.

Conclusive verdict:

However, the Nevada Gaming Control Board reportedly disagreed via a 13-page finding by proclaiming that it maintains ‘full and absolute power’ to enforce public gaming policies and make recommendations to the Nevada Gaming Commission regarding whether an individual’s earlier finding of suitability should be revoked.

Reportedly read a statement from the Nevada Gaming Control Board…

“There is no language in the Gaming Control Act that even hints that the Board’s investigatory and disciplinary powers are dependent on a person’s current nexus with a gaming licensee. The Act does allow for the ‘surrender’ of a gaming license but spells out mandatory procedures for the effective surrender of that license. A surrender is not effective until this commission accepts it. Even after surrender of a license, the former licensee remains liable for penalties, fines, fees, taxes or interest due.”